Linking Chains and Enhancing Asset Liquidity Across Ecosystems

Authors

Content Table

Abstract

1. When blockchain first began to reshape the digital landscape

The Entangle Protocol is not just about bridging gaps; it's about redefining how blockchains communicate and interact. At its core, Entangle aspires to eliminate the barriers that restrict blockchain technology's potential, making data and asset transfers across chains as simple and transparent as possible. By doing so, Entangle aims to catalyze a new era of blockchain utility—one where developers and users alike can tap into a truly interconnected digital world. This protocol is designed to be the backbone of a more fluid, scalable, and accessible blockchain ecosystem, empowering developers, enterprises, and end-users with the tools they need for the next generation of Web3 applications.

2. Web3 Communication, Scalability, and Liquidity Challenges

The decentralized nature of blockchain, while a boon for security and transparency, introduces significant challenges in communication and data sharing across different networks. Each blockchain operates with its own set of rules, consensus mechanisms, and data structures, making cross-chain communication cumbersome. This lack of interoperability not only stifles innovation but also complicates user experience and limits application potential.

As blockchain applications gain popularity, scalability issues become increasingly evident. Networks like Ethereum have faced high transaction fees and slower processing times during peak usage. These limitations are not just a matter of efficiency; they represent significant barriers to adoption for both users and developers, who require fast, cost-effective solutions to meet the demands of modern digital applications.

In the DeFi sector, liquidity is often spread thin across various protocols and blockchains, leading to inefficiencies and increased costs. This fragmentation makes it challenging to unlock the full potential of digital assets, as moving assets across ecosystems can be risky, slow, and expensive. The need for a unified liquidity solution is clear, one that can aggregate and optimize asset utilization across the entire Web3 landscape.

3. State of Web3: Oracles and Interoperability

Blockchain oracles serve as critical bridges between blockchain networks and the external world, enabling smart contracts to interact with off-chain data and systems. These entities play a pivotal role in the functionality and expansion of blockchain applications by allowing smart contracts to execute based on real-world inputs and outputs. They are not the source of data themselves but act as intermediaries that validate, verify, and authenticate external data before relaying it to the blockchain. This capability is essential for the creation of a verifiable web, enhancing the interoperability between isolated blockchains and the broader digital and physical worlds.

Blockchain oracles can be categorized based on their data sources, operational mechanisms, and direction of data flow. Understanding these types helps to appreciate the versatility and complexity of oracle solutions within blockchain ecosystems.

A centralized oracle acts as a singular point of data transmission, where one source provides data to the blockchain. This model, while efficient and straightforward, introduces a point of failure risk, as the integrity and security of the data depend entirely on the single data provider.

To mitigate the risks associated with centralized oracles, decentralized oracles distribute the responsibility of data verification across multiple sources. This approach enhances data reliability and security, making it more resistant to manipulation and single points of failure.

Use Cases of Blockchain Oracles

Oracles play a crucial role in the DeFi ecosystem by providing accurate, real-time financial data such as cryptocurrency prices, interest rates, and liquidity metrics. This data is essential for executing trades, managing collateral levels, issuing loans, and ensuring fair and transparent operation of financial instruments like stablecoins, lending protocols, and synthetic assets.

Oracles integrate real-world data into blockchain-based supply chain solutions, offering unprecedented transparency and traceability. They can verify the location, condition, and authenticity of goods as they move through the supply chain, from production to delivery. This capability is vital for preventing fraud, ensuring regulatory compliance, and enhancing consumer trust.

Prediction markets utilize oracles to determine the outcome of future events based on real-world data. Participants can bet on various outcomes, such as election results, sports events, or market trends. Oracles then feed the actual outcomes into the blockchain to settle bets, ensuring fairness and transparency in the process.

In blockchain gaming and NFT platforms, oracles can introduce dynamic elements based on real-world data or actions. This includes changing game mechanics based on real-world events or adjusting the attributes of an NFT based on external data, adding a layer of interactivity and realism to digital assets.

Beyond specific industries, oracles enable smart contracts to automatically execute transactions based on predefined conditions being met. This could include payment releases upon the successful delivery of goods, automatic execution of trade agreements when certain market conditions are met, or any contractual agreement that requires real-world data for its fulfillment.

(coinbase, n.d.)

Challenges in Blockchain Oracles

1. The Oracle Problem:

The oracle problem is a fundamental issue within blockchain applications, where the reliance on external data sources introduces a layer of trust into otherwise trustless systems. This challenge is especially pronounced in DeFi, where oracles are pivotal for providing accurate asset data. Poorly selected or managed oracles can endanger the investments of a growing number of participants, as evidenced by various hacks leading to significant financial losses. The oracle problem underscores the controversial aspect of real-world applications on blockchain due to the potential loss of decentralization and the inherent risks of relying on external data sources.

A critical challenge for blockchain oracles is ensuring the integrity and security of the data they provide. Manipulation of oracle data can lead to adverse outcomes, such as incorrect execution of smart contracts, unfair financial gains, and loss of user trust. The centralized nature of many oracles creates points of failure, where the data source or the oracle itself could be compromised, either intentionally or due to system vulnerabilities.

The criteria for selecting and managing oracles in DeFi platforms are often opaque to end-users. This lack of transparency and standardization can result in the adoption of oracles that are not best suited for the application's specific needs, thereby increasing the risk of data inaccuracies and manipulation. Establishing standardized protocols and transparent criteria for oracle selection and management is essential for mitigating these risks.

While decentralized oracles aim to reduce the risk of manipulation by distributing data validation across multiple sources, they still face challenges related to coordination, consensus mechanisms, and ensuring a diversity of reliable data sources. Conversely, centralized oracles, although potentially more efficient in data delivery, introduce risks associated with single points of failure and central points of control.

DeFi applications rely on oracles to adapt to real-world events and market changes rapidly. However, delays in data transmission, inaccuracies in real-time reporting, and the inability to quickly respond to unexpected events can lead to significant discrepancies between the oracle data and actual market conditions. These discrepancies can trigger unjustified contract executions and financial losses.

The behavior of oracle providers and data sources is heavily influenced by economic incentives. Misaligned incentives can lead to behaviors that compromise data integrity, such as providing inaccurate data for financial gain. Establishing appropriate economic incentives and penalty mechanisms is crucial for encouraging honest behavior among oracle providers.

Technical challenges, including scalability, data throughput, and integration with diverse blockchain platforms, pose significant hurdles for oracle functionality. Ensuring that oracles can efficiently handle large volumes of data requests without compromising speed or security is essential for their effective operation within the DeFi ecosystem.

Leading Oracle Solutions in Blockchain

Interoperability in Web3

Interoperability in the blockchain ecosystem is crucial for seamless communication and data exchange across different platforms, enabling a unified, multi-layered Web3 framework. It allows different blockchain networks to share data and transactions, essential for cross-chain dApps that operate across blockchains, enhancing functionalities like DEXs, money markets, NFTs, and DAOs.

Ways of Blockchain Interoperability

Notary Schemes

Notary schemes rely on trusted entities (notaries) to authenticate and relay transactions between blockchains. These can be centralized, involving a single trusted entity, or decentralized, with multiple parties acting collectively to validate and process cross-chain transactions.How It Works: In a notary scheme, when a transaction needs to cross from one blockchain to another, it's first sent to the notary. The notary verifies the transaction's legitimacy and then triggers a corresponding transaction on the target blockchain.

Examples: Centralized Exchanges such as Binance, HTX and others serve as practical examples. They manage users' assets across different blockchains within their platforms, effectively acting as notaries that users trust to securely facilitate cross-chain transfers.

Challenges: Notary schemes introduce trust in third parties, contradicting blockchain's decentralization ethos, and pose risks with centralized points that may fail or be attacked, compromising cross-chain transaction security.

Sidechains/Relays

Sidechains are independent blockchains that are connected to a parent (mainchain) blockchain via a two-way peg. This connection allows assets and data to be transferred between the mainchain and the sidechain, potentially offloading traffic and enabling enhanced functionalities or testing new features without impacting the mainchain's stability.How It Works: Assets can be locked in a smart contract on the mainchain, and a corresponding amount of the asset (or a representation of it) is then released on the sidechain. This process is reversible, allowing assets to move back to the mainchain.

Examples: Polygon (MATIC) facilitates asset transfers and interoperable blockchain applications with Ethereum as its mainchain. Liquid Network provides a Bitcoin sidechain solution aimed at faster transactions and enhanced privacy.

Challenges: Sidechains and relays, tailored for specific ecosystems, lack universal applicability, limiting their interoperability across diverse blockchains. They may not scale effectively, impacting their utility in a multi-blockchain environment.

Hash-Locking

Hash-locking involves using a cryptographic hash function to lock assets in a contract on one blockchain, with the release condition tied to revealing a secret that produces a known hash value. This mechanism is crucial for executing secure, trustless transactions between blockchains without intermediaries.How It Works: In hash-locking, a transaction or asset is locked using a hash function. The asset can only be unlocked on another blockchain by revealing a secret preimage that matches the hash. This method is often used in atomic swaps.

Examples: Atomic Swaps enable direct, secure exchanges of cryptocurrencies between two different blockchains using hash-lock contracts. Hashed Timelock Contracts (HTLCs) are employed in payment channels, allowing secure, conditional, and time-bound transactions across blockchains.

Challenges: Hash-locking schemes depend on smart contracts, excluding blockchains without this feature and can delay transactions, hindering instant settlements.

The absence of universal interoperability standards complicates the integration of diverse blockchain networks, leading to fragmented development efforts. Security concerns are heightened with interoperability, as cross-chain transactions introduce new vulnerabilities in varied security models. Technical complexities can hinder user experience, posing challenges in achieving intuitive interoperability without sacrificing security. Privacy issues arise when sharing data across chains, potentially exposing sensitive information. Regulatory compliance becomes more complex with cross-chain asset movements, given the different legal frameworks governing blockchains. Overcoming these challenges necessitates innovative, collaborative efforts and technological advancements to forge secure, user-friendly, and universally applicable interoperability solutions.

Layer 0 Protocols

Layer 0 protocols form the underlying framework that enables interoperability among blockchain networks by acting as a foundational layer beneath Layer 1 and Layer 2 solutions. They facilitate seamless cross-chain communication, enhance scalability by distributing workloads across networks, ensure security through advanced cryptographic methods, and uphold decentralization by avoiding central points of control.Key functionalities include enabling asset transfers and data sharing across blockchains, supporting scalable and secure cross-chain applications. Notable examples of Layer 0 technologies include Polkadot, which connects blockchains through a central relay chain; Cosmos, which uses the Inter-Blockchain Communication protocol for asset and data transfers; and Quant Network's Overledger, which offers a gateway for multi-chain interactions.

By providing a universal infrastructure for blockchain interoperability, Layer 0 protocols are crucial for developing a cohesive, efficient, and scalable blockchain ecosystem, driving forward the interconnected Web3 landscape.

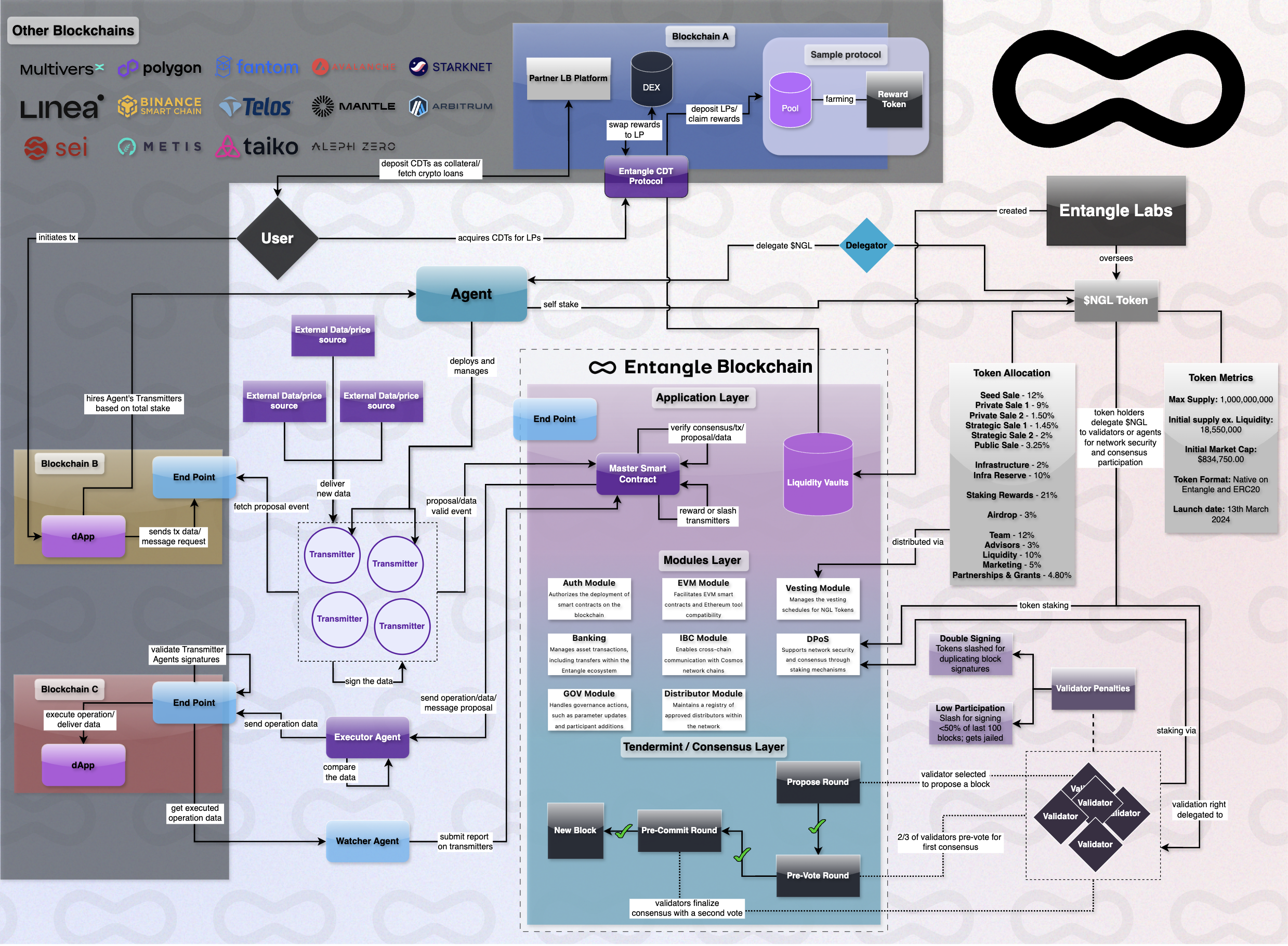

4. Entangle Protocol Overview

Over the past decade, the blockchain industry has transcended its initial cryptocurrency origins, morphing into a multifaceted ecosystem valued at over $2 trillion. At its core, blockchain technology revolves around the management and processing of vast amounts of data to unlock value across various platforms. However, the industry faces significant challenges, notably the seamless integration of dozens of blockchain networks and the harmonious connection of Web2 and Web3 data and assets.

Entangle addresses these complexities by offering a cohesive user experience on the blockchain, significantly reducing the barriers to blockchain usage and enhancing the efficiency of development and interoperability. The protocol's introduction marks a pivotal step toward eliminating the technical and operational silos that have hindered the blockchain industry's unified growth.

Entangle's mission extends beyond the provision of technical solutions; it aims to fundamentally transform how developers and decentralized applications (dApps) interact with blockchain data. By enabling secure, adaptable, and interoperable data access, Entangle lays the groundwork for a more fluid and expansive blockchain ecosystem. This not only boosts liquidity across platforms but also unlocks new scalable opportunities for web3 and the broader internet landscape.

Entangle introduces a suite of innovative products designed to solve critical challenges in the blockchain ecosystem, focusing on interoperability, data integrity, and liquidity optimization. These core products include the Photon Messaging Protocol, Universal Data Feeds, Price Feeds, and Liquid Vaults. Each product is crafted to provide unique solutions that drive forward the capabilities of decentralized applications (dApps) and blockchain networks.

A versatile framework enabling secure, customizable omnichain communication across both EVM and non-EVM networks. This protocol empowers sophisticated messaging capabilities, facilitating a wide range of use cases from cross-chain asset management to trustless bridging. It leverages sophisticated components, such as Executor Agents and Receiver Agents, to ensure security and provide extensive flexibility over consensus parameters, enabling a broad spectrum of use cases from managing omnichain assets to establishing trustless bridging.

- Interoperable real-world assets and omnichain stablecoins.

- Trustless bridging and cross-chain dApps, enhancing functionalities across lending, borrowing, and decentralized autonomous organizations (DAOs).

- State acquisition and collateral acceptance across different chains, facilitating seamless cross-chain trading and yield aggregation strategies.

The Photon Messaging Protocol serves as a foundation for efficient and secure omnichain communication, enabling a variety of applications:

- Omnichain Assets Management: It allows for the seamless management of assets, including stablecoins, across different blockchains, enhancing the fluidity of asset transfers and operations.

- Cross-Chain Swaps and Trustless Bridging: Facilitates direct asset exchanges between different blockchains without the need for centralized intermediaries, promoting a decentralized and secure trading environment.

- Smart Contract Automation Across Blockchains: Enables automated operations and interactions between smart contracts located on separate blockchains, thereby extending the functionalities of dApps to operate beyond the confines of a single network.

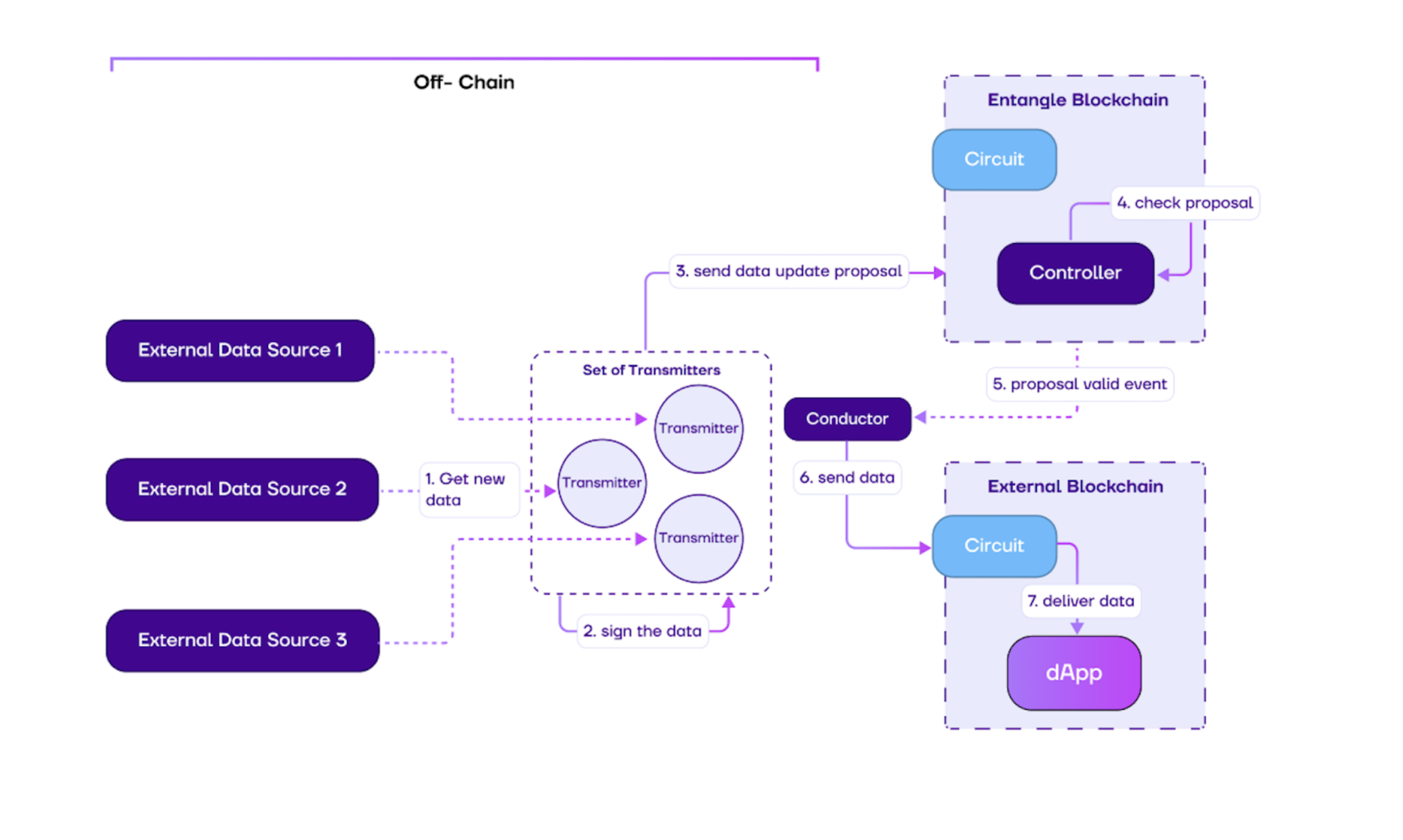

As the backbone of Entangle's oracle system, these data feeds provide economical, low-latency, and secure access to a broad spectrum of on-chain and off-chain data sources. This infrastructure supports the efficient delivery of critical information to smart contracts, enhancing the utility and reliability of blockchain applications. This infrastructure is crucial for the seamless querying and delivery of data to smart contracts, enhancing the efficiency and reliability of blockchain applications across various narratives in the crypto space, including real-world assets (RWAs), GameFi, asset pricing, and loan collateralization.

- The tokenization of real-world assets (RWA), enabling accurate and accessible data for decentralized exchanges (DEXs), and money markets protocols.

- Providing a suite of authenticated, customizable cryptocurrency price feeds critical for applications like Liquid Vaults, which depend on accurate, real-time asset valuations.

Entangle's data infrastructure supports a wide array of use cases by providing secure, real-time data to smart contracts and dApps:

- Real World Assets (RWAs) Tokenization: Supports the accurate and timely representation of real-world asset values on the blockchain, opening pathways for innovative financial products and services.

- GameFi and Asset Pricing: Provides the critical data needed for GameFi applications and dynamic asset pricing mechanisms, ensuring fair and transparent operations.

- Loan Collateralization and On-Chain Derivatives: Enhances the reliability and functionality of lending platforms and derivative products by supplying essential market and asset data.

As Entangle's first native application, Liquid Vaults are designed to create Composable Derivatives Tokens (CDTs) based on yield-bearing assets. This innovative solution aims to augment liquidity and optimize returns, presenting a new step in the evolution of on-chain assets and their composability within the DeFi landscape.

- Enhanced capital efficiency and liquidity through innovative financial instruments.

- Diverse use cases in lending, borrowing, and derivatives protocols, where Liquid Vaults serve as collateral for borrowing or yield enhancement strategies.

Liquid Vaults, Entangle's flagship application, brings several advantages to the DeFi space by creating Composable Derivatives Tokens (CDTs) from yield-bearing assets:

- Capital Efficiency and Refinancing: Users can leverage their yield-bearing assets more effectively, maintaining earnings on underlying positions while accessing new financing opportunities.

- Enhanced Liquidity: dApps benefit from improved liquidity retention and access to new sources, fostering a more vibrant and efficient DeFi ecosystem.

- Increased Protocol Liquidity Sharing: Facilitates a cooperative liquidity model among different protocols, enhancing the overall capital efficiency and utility within the DeFi landscape.

Integral to the Entangle ecosystem, the $NGL token powers the network's operations and governance. It serves several key functions:

- Facilitating transactions and operations across Entangle's products.

- Enabling staking mechanisms for security and governance participation.

- Incentivizing users and developers within the Entangle ecosystem.

Beyond these specific products, Entangle's infrastructure supports a diverse range of applications and dApps, making it a versatile tool for addressing the evolving needs of the blockchain community. Its ability to facilitate secure, adaptable, and interoperable data exchange positions Entangle as a critical player in the blockchain industry, capable of adapting to various market conditions and demands.

Entangle Blockchain Architecture

To ensure seamless interoperability with the Ethereum Virtual Machine, Entangle employs the Ethermint Library. This integration allows for the deployment of smart contracts written in Solidity on the Entangle Blockchain, thereby enhancing composability between Entangle and EVM infrastructure.

5. Scaling Web3: Entangle's Innovative Approach

5.1 Introduction to Web3 Scaling

Scaling in the Web3 ecosystem refers to the enhancement of blockchain networks to support higher transaction throughput, reduced transaction costs, and improved interoperability among different chains. As the blockchain space evolves, scalability remains a critical challenge, affecting user experience and limiting blockchain's mainstream adoption. Traditional scaling solutions have focused on layer 1 (L1) enhancements, like increasing block size, and layer 2 (L2) solutions, such as rollups and sidechains, to offload transaction processing from the main chain.

5.2 Entangle's Vision for a Scalable Web3 Ecosystem

Entangle emerges as a pioneer in the Web3 space by introducing a suite of innovative products aimed at tackling the trifecta of interoperability, data integrity, and liquidity optimization. Their offerings, including the Photon Messaging Protocol, Universal Data Feeds, Price Feeds, and Liquid Vaults, are designed to address the nuanced challenges of the blockchain ecosystem. Entangle's strategy revolves around enhancing the core functionalities of blockchains to support diverse applications, from cross-chain asset management to decentralized finance (DeFi) operations, thereby facilitating a more unified and efficient blockchain ecosystem.

5.3 The Photon Messaging Protocol: A Keystone of Entangle's Scalability Solutions

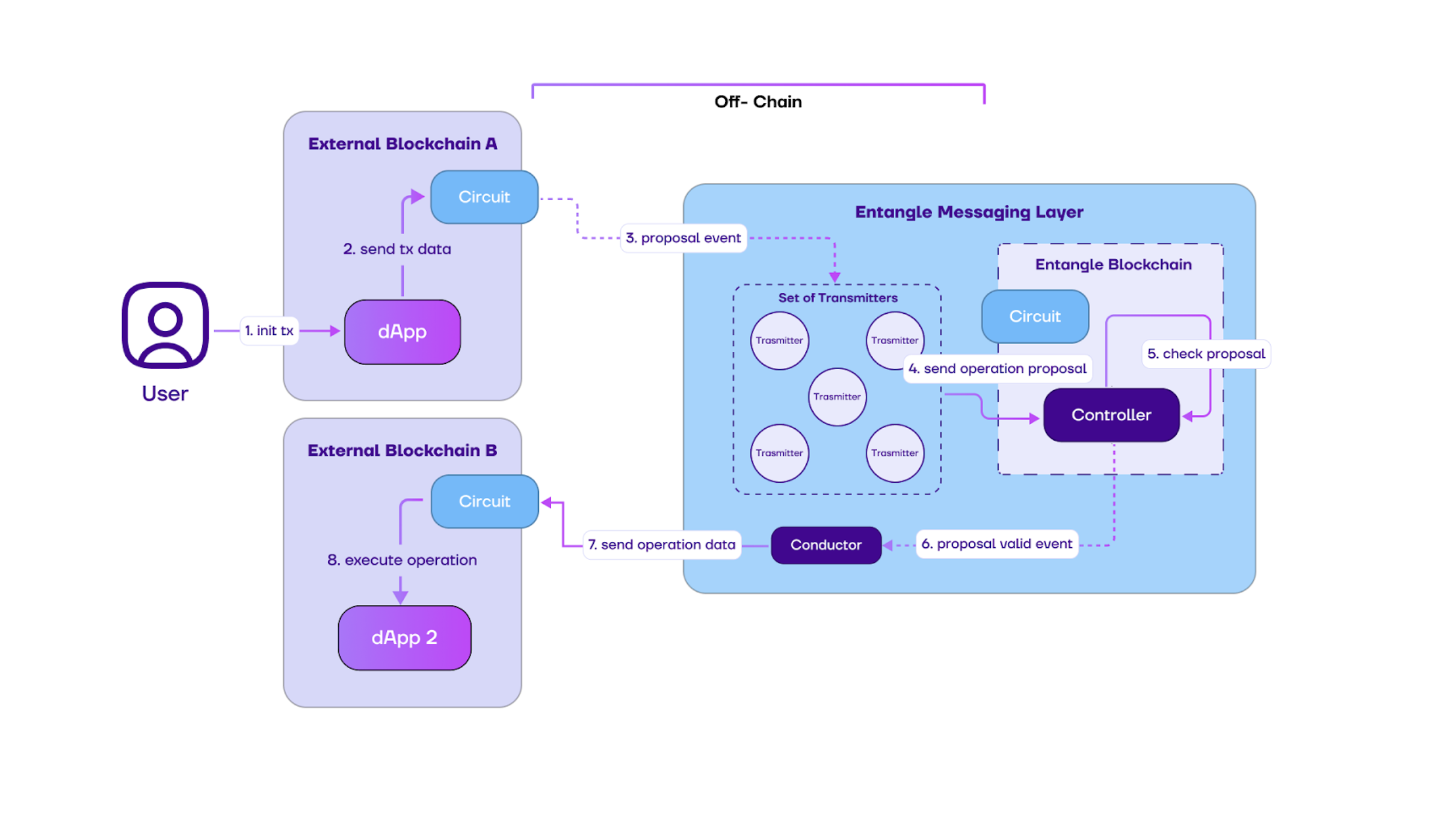

The Photon Messaging Protocol stands as a pivotal innovation in Entangle's arsenal to address Web3 scalability challenges. It is meticulously designed to enable fully customizable, fast, and secure omnichain communication across both EVM and non-EVM networks, addressing the critical barrier of siloed blockchain ecosystems that hinder Web3 adoption.

Interoperability and Unified Ecosystem:

The protocol transcends traditional blockchain boundaries by connecting 15+ chains, thus enabling the creation of omnichain dApps, tokens, and user experiences. This breadth of connectivity is instrumental in fostering a unified ecosystem where applications and assets can communicate across an expansive network of blockchains with a single deployment, directly addressing the scalability concern by distributing the load and enhancing the efficiency of cross-chain transactions.

Customizable Security and Consensus:

One of the protocol’s standout features is its fully configurable setup, allowing developers to tailor key parameters related to consensus, security, and data streaming. This flexibility ensures that dApps can strike an optimal balance between security, decentralization, and cost-efficiency, which is crucial for scalable solutions. The Photon Messaging Protocol's architecture, including a customizable Security Stack and a distributed network of agents, ensures that messages are transferred with maximal security and resistance to censorship.

Agents Network and Revenue Sharing:

The protocol employs a sophisticated network of agents, including Transmitter Agents (off-chain PoS machines) and Executor Agents (external developer agents), which collectively play a critical role in the protocol's operation. This network not only supports the aggregation and transmission of blockchain data but also facilitates a revenue-sharing model through the use of $NGL tokens, rewarding validators, transmitter agents, and their delegates, thereby incentivizing participation and ensuring the protocol's robustness and reliability.

Enhanced Security Measures:

The protocol's security is fortified by a hybrid proof of collateral model, integrating the Entangle Blockchain with 100 validators and transmitter agents. This model authenticates messages securely, showcasing a dynamic approach to maintaining security while facilitating scalable, omnichain communication.

Operational Mechanics:

At its core, the Photon Messaging Protocol leverages immutable on-chain endpoints (Gateways) and a Master Smart Contract (MAS) on the Entangle Blockchain to authenticate and execute transactions across chains. This process is initiated when Transmitter Agents fetch transaction information from an endpoint, validate it through a consensus mechanism, and then pass it to the MAS for final verification. Once approved, Executor Agents execute the transactions on the destination chain, illustrating a seamless and secure method for omnichain transactions. The Photon Messaging Protocol is a critical component of Entangle's approach to scaling the Web3 ecosystem. By addressing key challenges such as interoperability, transaction efficiency, and cross-chain communication, the protocol not only enhances the capacity of blockchain networks to handle a greater volume of transactions but also ensures that these advancements are achieved without compromising on security or decentralization. This holistic approach to scalability underscores Entangle's commitment to advancing a more integrated, efficient, and scalable blockchain landscape.

5.4 Enhancing Scalability Through Universal Data Feeds

The integration of Universal Data Feeds by Entangle signifies a transformative leap towards resolving the scalability dilemmas faced by blockchain networks. This innovative oracle protocol, distinguished by its ability to standardize and streamline the flow of data from disparate Web2 and Web3 sources to smart contracts, plays a pivotal role in amplifying the scalability, efficiency, and interoperability of blockchain applications.

Optimized Data Utilization for Scalable Smart Contracts

At the heart of Universal Data Feeds is the capability to furnish smart contracts with on-demand, authenticated data in both push and pull formats. This adaptability empowers developers to design more dynamic and efficient applications, as smart contracts can now interact with a broader spectrum of data sources with minimal latency and overhead. The consequence is a marked reduction in the computational strain on blockchains, thereby enhancing their throughput and scalability. This streamlined data integration process is crucial for supporting a growing number of decentralized applications (dApps) without compromising on performance or security.

Fostering Interoperability Across the Blockchain Ecosystem

Universal Data Feeds facilitate seamless data delivery across any EVM and non-EVM networks, breaking down the barriers between isolated blockchain infrastructures. This cross-chain compatibility is essential for creating a more cohesive and scalable blockchain ecosystem, where data and assets can fluidly move across different networks. By enabling dApps to access and utilize data from any source without network constraints, Universal Data Feeds significantly extend the operational scope and scalability of blockchain applications.

Customization at the Core of Efficiency

A defining feature of Universal Data Feeds is the extensive customizability it offers developers in terms of data workflow parameters. This flexibility allows for the optimization of data processing, ensuring that dApps can be finely tuned for cost efficiency and performance. By providing tools to customize the logic for data calculation and execution, the protocol ensures that only necessary data is processed and stored, further contributing to the scalability of the blockchain infrastructure.

Incentivization Mechanism and Robust Security Framework

Incorporating a hybrid proof of collateral model, Universal Data Feeds ensure the authenticity and reliability of data through a secure, incentivized network of validators and transmitter agents. This security model, coupled with revenue sharing via the native NGL token, guarantees the integrity of data feeds, a critical component for the scalable and efficient execution of smart contracts. Secure, timely, and accurate data is fundamental for the reliable operation of complex dApps, and by providing such a framework, Universal Data Feeds directly contribute to the scalability and robustness of blockchain networks.

Universal Data Feeds by Entangle address a crucial aspect of blockchain scalability by optimizing how data is integrated and utilized within the ecosystem. Through enhanced data access and interoperability, customizable workflows, and a secure, incentivized delivery model, these feeds are instrumental in advancing the scalability and functionality of blockchain networks. By enabling efficient and reliable data communication across various blockchain platforms, Universal Data Feeds set a new standard for data integration in the blockchain space, paving the way for more scalable, interoperable, and efficient dApps.

5.5 Custom Price Feeds: Catalyzing Scalability in DeFi

Entangle's Custom Price Feeds are a game-changing component in the pursuit of DeFi scalability. Traditional one-size-fits-all oracle solutions are insufficient for the diverse and growing needs of decentralized finance. Entangle addresses this by providing customizable, secure, and interoperable oracle solutions that can receive verified asset prices from any chain or source, effectively tailoring to the specific needs of developers and applications.

Flexible and Reliable Price Data Access

Custom Price Feeds enable applications on any blockchain to receive asset prices in various flexible ways: on-demand, at user-defined time intervals, or triggered by a threshold of price changes. This flexibility is crucial for DeFi applications that require precise and timely price information for operations such as executing trades, managing liquidity, or triggering smart contract functions.

Boosting DeFi's Efficiency and Innovation

The availability of accurate and customizable price data is fundamental for the scalability of DeFi ecosystems. By ensuring that dApps can access high-integrity data, Custom Price Feeds allow for more complex and innovative financial products to be built. For instance, they enable the refinancing of yield assets and other sophisticated financial mechanisms that require up-to-the-minute price information.

Enhancing Cost-Efficiency

By delivering data only as needed, whether on-demand or at specific intervals, Custom Price Feeds ensure that the consumption of network resources is optimized, reducing unnecessary expenditure. This cost-efficiency is paramount in a scalable system, as it allows for the growth of the network and its services without proportionally increasing operational costs.

Decentralized and Secure Data Aggregation

The Price Oracle Contract on the Entangle Blockchain serves as the cornerstone of data integrity, monitoring for discrepancies and statistical anomalies to generate a median price. By broadcasting prices to other blockchains only when significant deviations occur, Custom Price Feeds maintain high data fidelity and reduce unnecessary data transmission, contributing to a leaner and more scalable blockchain environment.

Liquid Vaults: Amplifying DeFi Scalability Through Capital Efficiency

In DeFi, fragmentation occurs when resources are spread thinly across various protocols and chains, leading to inefficiencies and restricted growth. Liquid Vaults address this by centralizing the utility of different yield-bearing assets, allowing for the strategic redeployment of liquidity. By enabling assets to flow more freely between different protocols and chains, Liquid Vaults reduce the barriers to scalability, allowing the ecosystem to expand without the traditional constraints imposed by isolated liquidity pools.

Liquid Vaults facilitate a multi-chain approach to asset management, enabling liquidity to move across various chains. This fluidity is paramount for scalability, as it ensures that liquidity is not locked in one place but can be directed where it is most needed. This flexibility allows DeFi protocols to adapt to changing market conditions and user demands without being hindered by the underlying infrastructure.

By allowing users to collateralize LP tokens, Liquid Vaults maximize the utilization of assets within the ecosystem. Collateralization means that assets which would otherwise be passive can now be actively used to secure loans or create new yield opportunities. This maximization of asset utility directly contributes to scalability by ensuring that every asset within the DeFi space is put to work, reducing idle capital and enhancing overall capital efficiency.

Liquid Vaults streamline the process of yield generation and refinancing. The platform's automatic staking and compounding features ensure that assets generate the highest possible returns without requiring constant user intervention. Additionally, by issuing CDTs, users can access liquidity without selling their assets, which promotes a more stable and scalable lending environment within the DeFi sector.

A direct impact of Liquid Vaults on scalability is the potential increase in TVL across the DeFi ecosystem. As more assets are efficiently utilized and yields are optimized, there is an incentive for more capital to enter and stay within the ecosystem. Increased TVL represents not just growth in size but also in stability and resilience, key indicators of a scalable network.

Entangle's Liquid Vaults are pivotal in scaling the DeFi ecosystem by resolving critical inefficiencies in liquidity management and yield generation. Through innovations such as composable derivative tokens, multi-chain capital fluidity, and enhanced asset utilization, Liquid Vaults deliver a more integrated, efficient, and responsive DeFi environment. This optimization of liquidity and capital across multiple chains is not merely an incremental improvement but a comprehensive scalability solution that enables sustainable growth and expansion in the burgeoning world of decentralized finance.

Entangle’s Role in Unifying Web3 Communication and Optimizing Ecosystem Liquidity

The current state of DeFi is characterized by fragmented liquidity and communication barriers across multiple blockchain ecosystems. This fragmentation causes inefficiencies, restricted asset flow, and reduced innovation potential in the DeFi sector. Entangle addresses the challenges of fragmented liquidity and scalability issues of decentralized ecosystems. By implementing a liquidity-centric sub-layer powered by its oracle-centric blockchain, Entangle creates a seamless interaction across diverse blockchains.

LSDs and CDTs:

- Users stake assets in Entangle, receiving LSDs in return.

- These LSDs are used in Synthetic Vaults to create CDTs.

- CDTs, being yield-bearing and versatile, can be employed in various DeFi strategies, enhancing liquidity and capital efficiency.

Vaults: Operational Hub

- Vaults are where LSDs are transformed into CDTs.

- They serve as platforms for various financial activities, leveraging the staked assets for additional yield generation or collateralization.

- CDTs within vaults provide users with more flexibility in managing their investments and participating in DeFi activities.

Oracles: Data Providers

- Oracles feed essential data into Entangle, crucial for pricing assets within the Vaults and across DeFi applications.

- Accurate data from oracles ensures that financial activities based on CDTs or other instruments are conducted fairly and efficiently.

Photon Messaging: Inter-Blockchain Communicator

- Photon Messaging facilitates the transfer of information and assets across different blockchain networks.

- It enables the utilization of Entangle’s services, like LSDs and CDTs, across a range of blockchain environments, not just limited to its native platform.

- This protocol is key to ensuring that Entangle's functionalities are available and operational across multiple blockchains.

Liquid Vaults’ Role

Liquid Vaults are aimed at resolving liquidity and communication barriers in DeFi. They harness the potential of LSDs to provide a dynamic approach to liquidity management across multiple blockchains, while enabling the seamless transfer and utilization of assets across diverse blockchain platforms, contributing to unifying Web3 communication.

Customization and incorporation of PoS-like security features ensure reliability and flexibility across blockchains. This capability is underpinned by Entangle's oracle-centric blockchain, which ensures accurate, timely data flow and smart contract functionality essential for cross-chain interactions.

By integrating Liquid Vaults, Entangle ensures that assets and data are not only transferable across chains but also retain their value and utility, enhancing the overall interoperability within the Web3 space.

Case Studies

Solana:

Liquid Vaults generate CDTs from yield-bearing assets within the Solana ecosystem, facilitating liquidity sharing among protocols, offering liquidity providers lucrative refinancing opportunities to maximize returns across diverse DeFi applications. By integrating the Photon Messaging Protocol, wallet services and other blockchain networks can achieve reliable, scalable omnichain communication, providing Solana with unparalleled SC automation and cross-chain interoperability. Customizable data enables seamless integration of Web2 data, facilitating applications within the Solana ecosystem and ensuring the security, speed, and reliability expected by traditional entities.

Arbitrum:

Entangle’s Photon Messaging Protocol, with its high customizability, empowers developers to innovate and extend the current offerings on Arbitrum, allowing connectivity to any Web3 ecosystem. It further allows the inclusion of dApps from other ecosystems, where instances can be set up on Arbitrum for users located on Arbitrum’s network. For Web3 to develop, interoperability is key and the photon messaging layer affords developers the flexibility to craft solutions tailored to industry needs as Arbitrum expands into areas such as RWA or liquid restaking Protocols. Emerging sectors like blockchain and the Internet of Things will also gain from the wide-ranging interoperability of this base solution.

Chainge Finance:

Chainge Finance exemplifies its ability to offer tailored liquidity solutions and oracle services. Recognizing that the existing DeFi protocols' UI/UX was hindering wider adoption, the team transformed it into a comprehensive hub for all DeFi activities. Services such as Spot trading, Futures, Options, Liquidity Provisioning, and more, are all available on the platform. To ensure a seamless omnichain experience, Chainge Finance taps into the cross-chain capabilities of the Fusion network. They developed a mobile application that offers the same array of services, thus reducing the barriers to DeFi even further. By integrating Synthetic Vaults and the Entangle Distributed Oracle Solution (EDOS) with Chainge Finance, Entangle enhances capital efficiency and introduces sophisticated DeFi strategies within Chainge's ecosystem.

Aleph Zero:

The collaboration with Aleph Zero demonstrates how Entangle's suite of services supports scalability and security. Entangle's Photon Messaging Protocol plays a pivotal role here, facilitating data validation and sourcing for dApps on Aleph Zero's Layer 1 blockchain. Incorporating data feeds from just about any Web3 and Web2 source imaginable, as well as being able to tailor the frequency and methods of data requests, allows developers to create the products that industries require as Aleph Zero scales into fields like Supply Chain and Manufacturing, Legal and Document services and many more.

Myso Finance:

Entangle’s integration with Myso Finance showcases how its LSDs can be used for cross-protocol collateralization of yield-bearing assets. Users can convert their LP position on Ethereum, or another supported network, into an LSD. Subsequently, it could be lent out on Myso, enabling the holder to earn not only on their underlying LP position but also on their lent assets. They could then leverage their lent assets as collateral to borrow funds from Myso, further enhancing their yield. This partnership enhances liquidity and capital efficiency within the Myso ecosystem, exemplifying Entangle’s role in optimizing DeFi strategies across different platforms.

Exploration of Entangle’s Customizable Data Sets

Benefits of Entangle's Price Oracle

- Stabilization During Market Volatility: The Price Oracle's aggregated price information could act as a stabilizing force during flash crash incidents, mitigating the impact of price deviations from a single exchange and preventing erroneous automated trades.

- Reliability in Rapidly Evolving Markets: In scenarios like the DeFi summer of 2020, the oracle's real-time updates can provide accurate pricing information, aiding traders in navigating the volatility and influx of new tokens.

- Transparency Against Manipulated Pricing: By aggregating prices from diverse sources, the Price Oracle can diminish the influence of market manipulation strategies, ensuring a more democratized and accurate market reflection.

Customization and Flexibility:

By enabling customizable oracles, Entangle ensures that

applications can access the exact data they need, in the precise

manner they require it, enhancing the efficacy and relevance of

blockchain solutions. Entangle’s Oracle Solution is tailored to

the needs of the protocol, offering customizable keeper

configurations. This flexibility allows developers to choose their

threshold consensus, ensuring the right balance between security

and cost. The customizable nature of Entangle's Oracle Solution

allows protocols to modify oracle functionalities, catering to

specific application requirements. This adaptability is crucial in

a diversified DeFi ecosystem, where applications need to interface

with various data sources, from financial markets to IoT devices.

Entangle's approach to oracle security involves a unique

stake-based system. Each oracle, or 'Keeper,' stakes $NGL tokens,

creating an environment of accountability. This mechanism ensures

the integrity of data and fortifies the oracle against

manipulations and external threats.

Despite the benefits, customizing oracles poses certain

challenges. Network congestion, especially in ecosystems like

Ethereum, can impact performance. Furthermore, the intricacies of

smart contract logic and maintaining balance between customization

and broad applicability are critical to address.

Accurate Data Aggregation

Entangle’s Oracle is designed to minimize costs and complexity, especially for SC automation across multiple blockchains. This solution involves storing data on-chain, processing it, and executing verifiable events as needed, rather than at fixed intervals. This approach not only reduces costs but also facilitates simultaneous execution of SC automation events across multiple chains, a feature critical for dApps like Entangle's Synthetic Vaults. To accurately assess the value of Liquidity Staking Derivatives (LSDs), the oracle compiles prices of linked pool tokens against stable currencies, streamlining the valuation process across different platforms. By employing an algorithm that considers median prices from multiple DEXs, the Price Oracle effectively eliminates price distortion caused by outliers, thereby simplifying the challenge of tracking and verifying crypto asset prices.

Arbitrage and Liquidity Management

The Price Oracle's ability to provide consistent pricing across various blockchains is pivotal in reducing arbitrage risks and harmonizing price disparities. During market downturns, the oracle's reliable liquidation rates enable timely decision-making, reducing risks for liquidity providers.

Universal Data Feeds

Entangle's Universal Data Feeds mark a significant advancement in

how decentralized applications interact with data. This novel

mechanism standardizes data streaming, making diverse Web2 and

Web3 data universally accessible across any network. The

limitations of current oracles in terms of data availability,

customization, cross-chain limitations, and authentication are

addressed head-on. Universal Data Feeds provide a comprehensive

solution to these longstanding issues.

Entangle’s approach to price feeds offers a transparent and

decentralized solution, essential in the trust-centric world of

DeFi. By aggregating price data from multiple sources, Entangle

mitigates the risks associated with single-source dependency,

ensuring data integrity and reducing manipulation risks. The

integration of price aggregation and calculation into an on-chain

smart contract enhances transparency, allowing stakeholders to

verify the source and derivation of prices.

The reliability and transparency of Entangle's price feeds enable

innovative applications like Liquid Vaults, showcasing its

potential to support advanced on-chain financial products.

Advanced Features of Universal Data

- Unified Collection and Processing: This feature revolutionizes how decentralized applications can access and process data from any source, breaking barriers between Web2 and Web3.

- Interoperable Infrastructure for Smart Contracts: Ensuring seamless access across EVM and non-EVM networks, Universal Data Feeds facilitate data dissemination, making it a versatile tool for a wide range of blockchain networks.

- Customizable Data Logic: Developers gain the unprecedented capability to tailor data processing workflows, offering flexibility to suit unique and complex application requirements.

- Push and Pull Data Delivery Models: Entangle empowers developers with options for timely data updates or cost-effective data retrieval, aligning with the diverse needs of various applications.

From pricing information to complex data sets, the UDFs are equipped to handle diverse data types with unique IDs, ensuring streamlined integration. Incorporating the $NGL model, Universal Data incentivizes validators and transmitter agents, reinforcing the robustness of the data feeds. Use cases like collateralization in Liquid Vaults, cross-chain gaming assets, and tokenization of real-world assets are now more feasible and efficient with Universal Data Feeds. With plans to support over 13 blockchain networks and integrate with 50+ DApps, Entangle's roadmap indicates a robust expansion and utilization of Universal Data Feeds.

Photon Messaging:

With features like Transmitters and Circuits, Photon Messaging ensures stable, secure, and cost-effective data delivery across chains, crucial for DEXs and DeFi protocols. Photon Messaging addresses the limitations of traditional on-chain push mechanisms. By offering a sophisticated off-chain push system, it enables DEXs on networks like Arbitrum to access real-time price feeds and other crucial data with greater speed and economic efficiency. The reliable on-chain price feeds are particularly beneficial for assets lacking stable off-chain data sources. This capability broadens the scope of assets that can be supported on DEXs, including the possibility of integrating perpetual contracts for emerging assets. The Keeper System lies at the core of Entangle’s data strategy, efficiently aggregating and formatting data for the blockchain. This system underscores the commitment to accuracy and reliability in data management. Entangle's data finalization process, which includes consensus voting and merkle root calculations, ensures the integrity and fairness of data. The customizable data distribution model further enhances the protocol's appeal, allowing for tailored data update frequencies and types, accommodating a diverse range of requirements.

(Universal and Customizable On Chain Data, 2024)These technologies address the pressing need for secure, adaptable, and cost-effective data solutions in the blockchain ecosystem. Entangle’s approach enhances existing DeFi platforms and enable new possibilities in DeFi.

Conclusion

The examination of the Entangle Protocol highlights its significant role in addressing communication, scalability, and liquidity challenges within the Web3 arena. By incorporating elements like the Photon Messaging Layer, customizable data sets, and Liquid Vaults, Entangle introduces a robust solution for enhancing interoperability and streamlining data exchange across diverse blockchain platforms. This analysis sheds light on Entangle's potential to reshape the blockchain landscape, offering a strong model for a more interconnected and efficient digital ecosystem. The protocol's approach to facilitating seamless cross-chain interactions and data fluidity sets a promising direction for future developments in blockchain technology, emphasizing the importance of innovative solutions in fostering a unified Web3 framework.